Patent evaluation report utilization strategy

- How can a patent evaluation be utilized?

- Available for use in a variety of forms as required by management

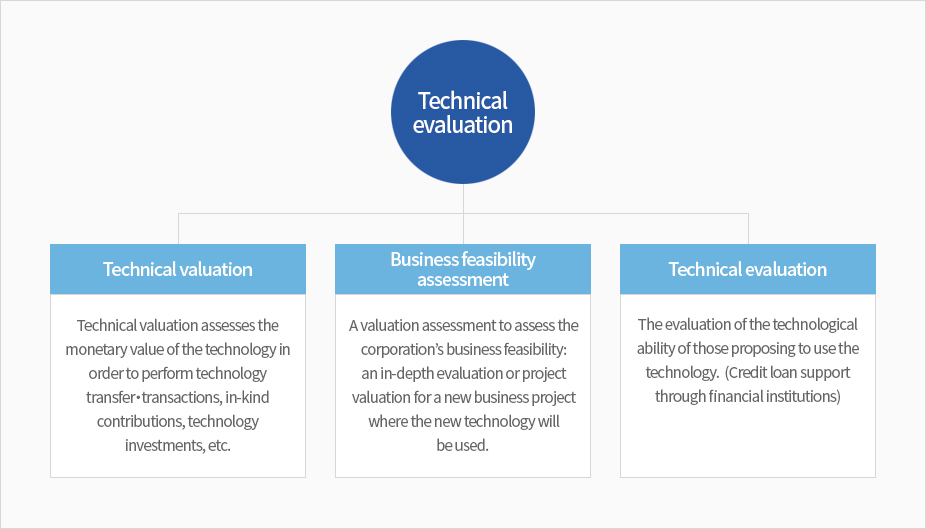

- Types of technical evaluations

- Purpose of the evaluation

-

- Transaction : Transaction pricing for technology purchase, sales and licensing.

- Finance : Finance securitization of the technology or setting up a mortgage, Capital increase, reduce interest rate

- Taxation : Capital increase, Taxation planning and payments for the donations, disposal and repayment of the technology.

- Strategy : Setting long-term management strategies to enhance the corporation’s value, technology commercialization, spin-offs, etc.

- Clearing : Asset valuation and debt repayment planning in the case of bankruptcy or corporate restructuring.

- Litigation : Estimation of damages such as patent infringements, defaults and other property related legal disputes.

- Policy : Grants additional points when applying to: Public institution support project, beneficiary of policy fund and the Public Procurement Service.

- Financial structure enhancement

-

- Debt-to-equity ratio stabilization : Debt-to-equity ratios stabilize as intangible assets increase, as a result of the increasing value of the evaluated patents.

- Resolution of provisional payment : If a representative transfers an individual patent to a corporation, it pays the representative a patent price, which can resolve the representative’s provisional payment.

- Tax-exemption effect (transfer of patent rights) : 80% of the payment is acknowledged as necessary expenses, as the payment is regarded as other income under the transfer of patent rights.

※ We offer consulting on government policy funds in 2018 (Shinbo, Kibo, SMBA, SBC, credit guarantee foundations, 2% interest rate deal from banking sector / prime financial institutions (banks etc.) and company operating fund.